VAT SERVICES

VAT Registration Services in the United Arab Emirates

If you want to own a small, medium, or large firm, you must apply for Registration in the UAE in line with Emirates Tax Laws. The fact that your firm is registered under the Dubai Tax Laws means that the government acknowledges it. The money made by your firm will determine whether or not you need to register for VAT in the UAE. AIG Corporate Services Provider is a major consultant in the UAE that provides excellent VAT registration solutions to the customers, as well as VAT de-registration, VAT bookkeeping, and VAT tax return, among other services.

Businesses face greater costs as a result of a VAT. It has the potential to facilitate tax evasion. Passed-on costs drive prices up, which are especially burdensome for low-income consumers.

If your company wants to invest for expensive technology or items, registering for VAT may be advantageous. Greater cash flow- Since you're paying more for items & services, you may expect to see greater profitability in your business, which shareholders always want.

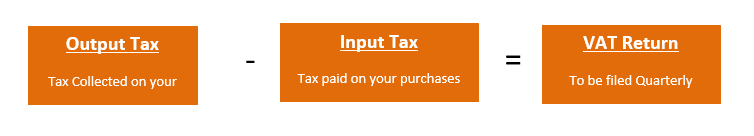

Business owners must submit Tax return once the VAT is fully operational, and businesses could indeed assert tax amount on certain investments, such as expenses for hosting a party, related expenses to a vehicle that can transport less than ten people and is free for individual use, expenses regarding the employees' families where businesses have no legal requirements, non-business expenditure, and so on. All of these prohibited input taxes will be passed on to enterprises as a cost.

The VAT return filing processThe following are the processes that must be performed in order to process the filing of VAT returns:

- Have an account with the Internal Revenue Service.

- Give the FTA information on the tax payer.

- Provide documentation for all VAT sales, expenses, as well as other inputs.

- Make a declaration.

For best performance of your business, you need to choose a suitable business model. AIG Corporate Services Provider offers following services for business owners:

- Mainland, Free Zones or Offshore company registration services in all Emirates of UAE

- Opening bank account with all local leading banks

Speak to our experts for assistance for registration of your company. We provide economical cost service, complete guidance and assist in completing all formalities.

Start your Business Today